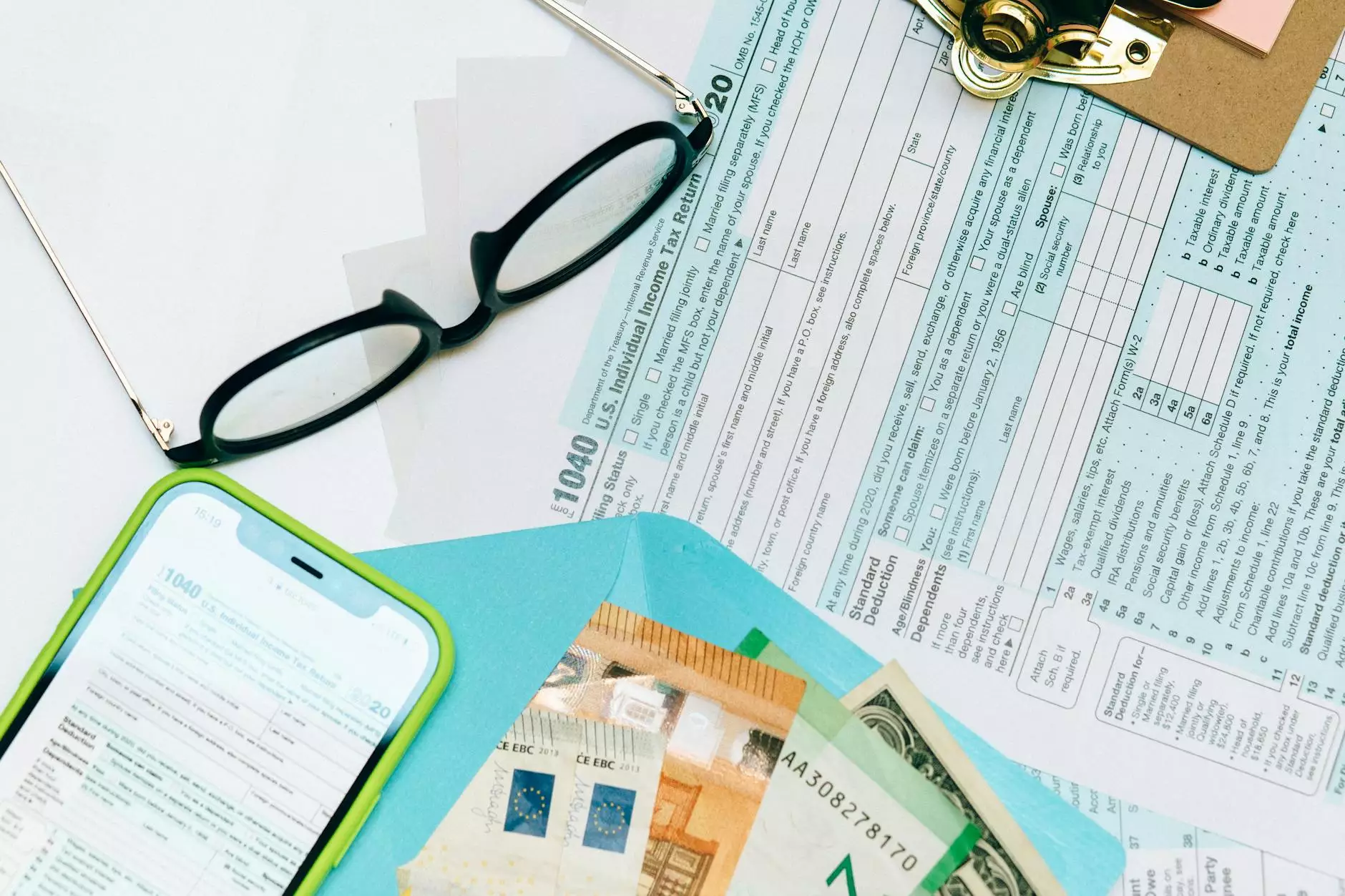

How Long to Keep Tax Records?

Introduction

In the world of finance, keeping proper tax records is essential for individuals and businesses. Understanding the duration for which tax records should be retained is crucial for better financial management. In this article, we will discuss how long you should keep your tax records and why it is important. Tax Accountant IDM, a leading financial services provider specializing in accounting and tax services, offers expert guidance to help you navigate through your tax obligations.

Why Are Tax Records Important?

Tax records provide an essential foundation for various financial activities. By maintaining accurate and up-to-date tax records, you can:

- Comply with legal requirements

- Facilitate audits and tax examinations

- Claim deductions and credits

- Resolve potential disputes with tax authorities

- Obtain accurate financial information for future planning

Duration for Keeping Tax Records

The duration for which you should retain your tax records primarily depends on the type of documentation and supporting evidence involved. While the guidelines may vary by jurisdiction, here are some general recommendations:

- Income Tax Returns: It is advisable to keep your federal and state tax returns, along with any supporting documents, for at least seven years. This period allows you to address any potential discrepancy or revisit your financial data if necessary.

- Business Expense Documentation: Retain records of business-related expenses, such as receipts, invoices, and mileage logs, for a minimum of seven years. This duration aligns with the statute of limitations for tax audits and potential deductions.

- Investments and Capital Assets: Keep records related to investments, stocks, mutual funds, and real estate transactions for as long as you own the asset, plus seven years after selling it. These records are essential to calculate capital gains or losses accurately.

- Employment and Payroll Records: Maintain employment-related records, including W-2 forms, 1099 forms, payroll calculations, and benefit statements, for at least seven years. These documents are necessary for future reference, tax reporting, and potential audit reviews.

- Property and Home Records: Keep records related to the purchase, sale, or improvement of a property for at least seven years after selling it. These records help determine capital gains and eligible deductions when filing tax returns.

Tips for Effective Record-Keeping

Organizing and managing your tax records efficiently ensures easier tax preparation, smoother audits, and improved financial planning. Here are some tips to help you maintain effective record-keeping:

- Create a System: Develop a structured paper or digital filing system to categorize and store your tax-related documents. Use separate folders or software to organize income, expenses, deductions, and other relevant aspects.

- Keep Digital Copies: Consider digitizing your tax records using secure software or cloud storage. This approach not only saves physical space but also offers better protection against loss or damage.

- Label and Date Documents: Clearly label and date each document to facilitate easy retrieval in the future. This practice helps identify the relevance and time frame of the records.

- Dispose of Confidential Information Securely: When disposing of tax records, make sure to shred or destroy any sensitive information to protect against identity theft or fraud.

- Consult with Professionals: Seek guidance from experienced accountants or tax professionals, like Tax Accountant IDM, to ensure compliance, understand specific regulations, and maximize tax benefits.

Conclusion

In summary, understanding how long to keep tax records is crucial for proper financial management. By adhering to the recommended durations mentioned above, you can maintain compliance, facilitate audits, and leverage accurate information for tax planning and reporting. Tax Accountant IDM, with its expertise in financial services, accountants, and tax services, can assist you in navigating through the complexities of tax obligations effectively. Don't underestimate the importance of proper tax record-keeping, as it plays a vital role in securing your financial well-being.