The Strategic Objectives of Real Estate Investment

Real estate investment serves as a cornerstone in the world of financial advising and investing. Whether you are an individual looking to secure your financial future or a business aiming to diversify your portfolio, understanding the objectives of real estate investment is paramount to success in this dynamic industry.

Building Long-Term Wealth

One of the primary objectives of real estate investment is to build long-term wealth. Real estate has historically proven to be a stable and appreciating asset class, offering investors the potential for significant capital growth over time. By strategically acquiring and managing properties, investors can generate ongoing rental income while benefiting from property value appreciation.

Diversification and Risk Mitigation

Diversification is crucial in any investment strategy, and real estate offers a unique opportunity to diversify one's portfolio. By allocating funds to real estate assets, investors can reduce overall risk exposure and enhance their portfolio's stability. Real estate provides a tangible and resilient investment option that can protect against market volatility and economic downturns.

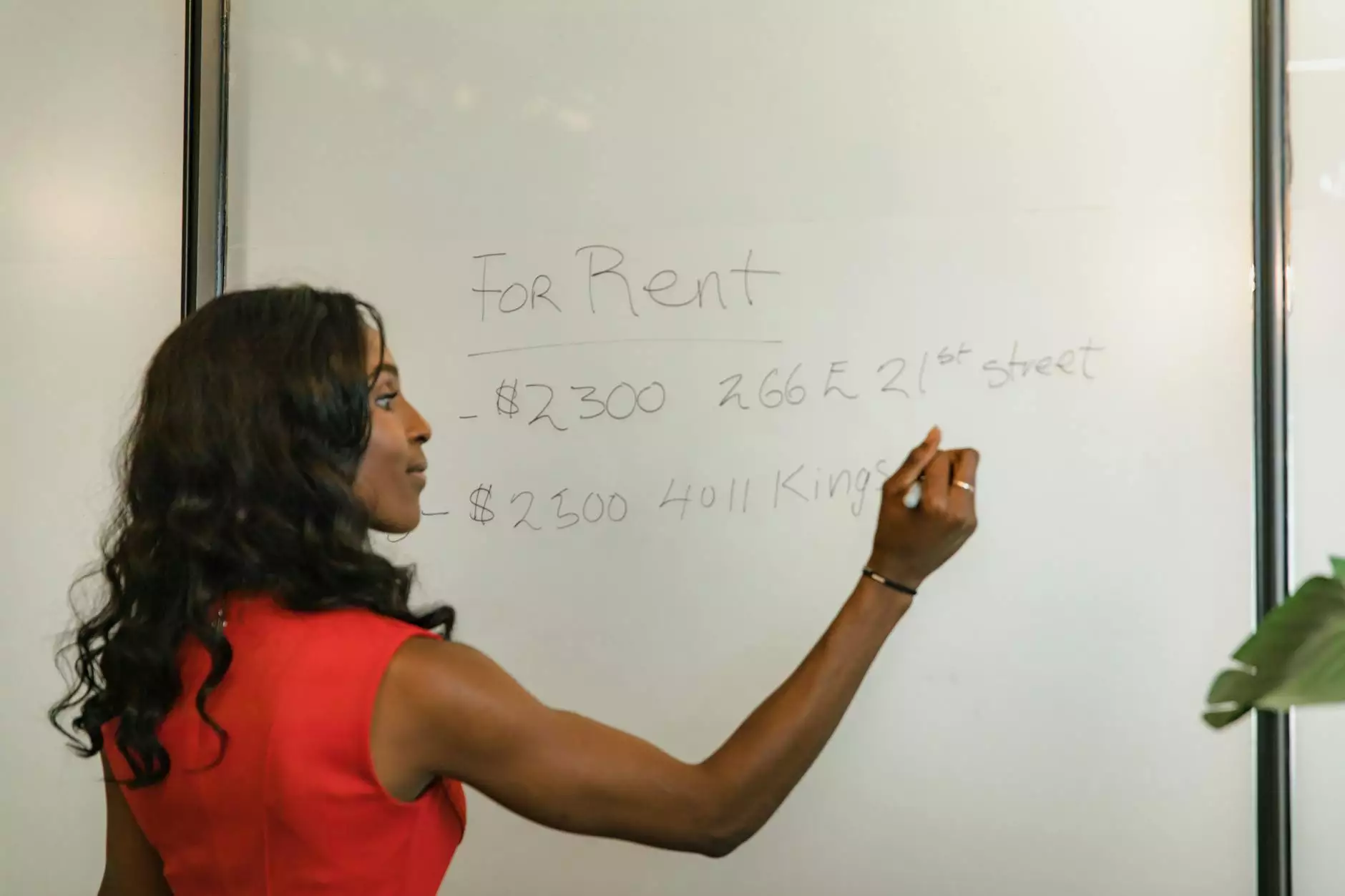

Generating Passive Income

Real estate investment presents an excellent opportunity for generating passive income streams. Rental properties, commercial real estate, and other real estate assets can produce steady cash flow, providing investors with a reliable source of income. Passive income from real estate investments can help individuals achieve financial independence and secure their financial future.

Tax Benefits and Wealth Preservation

Investing in real estate offers a range of tax benefits that can help investors optimize their financial position. Tax deductions on mortgage interest, property taxes, depreciation, and other expenses can significantly reduce the tax burden associated with real estate investments. Additionally, real estate investments provide a mechanism for wealth preservation, allowing investors to pass down assets to future generations.

Capturing Market Opportunities

Real estate investment objectives often revolve around seizing market opportunities and capitalizing on emerging trends. By staying informed about market dynamics, demographic shifts, and local economic indicators, investors can identify lucrative real estate opportunities. Whether it's investing in high-growth markets, distressed properties, or emerging neighborhoods, strategic investors can position themselves for maximum returns.

Strategies for Realizing Investment Objectives

When pursuing the objectives of real estate investment, it is essential to adopt sound strategies that align with your financial goals. Conduct thorough market research, assess property values and rental yields, and develop a diversified investment portfolio. Leverage financial advising and investing expertise to make informed decisions and optimize your real estate investment outcomes.

In conclusion, understanding the strategic objectives of real estate investment is key to navigating the complex landscape of real estate markets. By leveraging the diverse opportunities that real estate offers, investors can achieve long-term wealth growth, generate passive income, and mitigate risks effectively. With a well-defined investment strategy and a focus on realizing your objectives, real estate investment can pave the way to financial prosperity.

For more insights on financial advising and investing strategies tailored to real estate objectives, visit FinalyzeCFO.