Welcome to TaxWorry - Your Trusted Partner for Financial Services, Accountants, and Tax Services

Section 44AA: Unraveling the Benefits and Requirements

If you are a business owner in need of comprehensive financial services, accountants, and tax services, then look no further than TaxWorry. We are your one-stop solution for all your financial needs, ensuring that you can focus on what you do best: running your business.

In this article, we will delve into the details of Section 44AA of the Income Tax Act, providing you with an in-depth understanding of the benefits and requirements associated with it. By the end, you'll be equipped with the knowledge to make informed decisions that can drastically optimize your tax liabilities and improve your overall financial situation.

What is Section 44AA?

Section 44AA of the Income Tax Act mandates specific requirements for maintaining books of accounts and submitting them to the income tax department. It primarily applies to professionals, such as doctors, lawyers, architects, engineers, and accountants, who are eligible for the presumptive taxation scheme.

The section outlines two distinct scenarios:

- If your gross receipts or total turnover exceeds Rs. 1,50,000 in any of the three previous years

- If you have claimed profits and gains below the prescribed limits of the presumptive taxation scheme.

It is vital for professionals falling under these criteria to maintain accurate books of accounts to comply with income tax regulations.

Requirements Under Section 44AA

Section 44AA mandates specific requirements for maintaining books of accounts. It includes:

- Maintaining a record of all income and expenses related to the business

- Keeping vouchers, bills, bank statements, and other financial records

- Maintaining an inventory, if applicable

- Preparing balance sheets and profit and loss accounts, as well as relevant supporting documents

By fulfilling these requirements, professionals can ensure that they are compliant with the income tax laws and can avoid penalties for non-compliance.

Benefits of Complying with Section 44AA

While complying with income tax regulations might seem like a daunting task, it holds several advantages for professionals:

- Tax Benefits: Accurately maintaining books of accounts and complying with Section 44AA allows professionals to take advantage of tax-saving opportunities. It enables them to claim deductions, offset losses, and ensure tax efficiency.

- Transparency and Credibility: Properly maintained books of accounts enhance transparency and credibility for professionals. It showcases your financial integrity and builds trust with clients, lenders, and investors.

- Smooth Business Operations: Maintaining accurate financial records helps you keep track of your business's financial health. You gain insights into profit margins, cash flow patterns, and areas that require improvement. This knowledge translates into strategic decision-making and smoother operations.

- Compliance with the Law: By adhering to Section 44AA, professionals avoid legal complications and penalties. It demonstrates your commitment to upholding ethical and legal standards in your business.

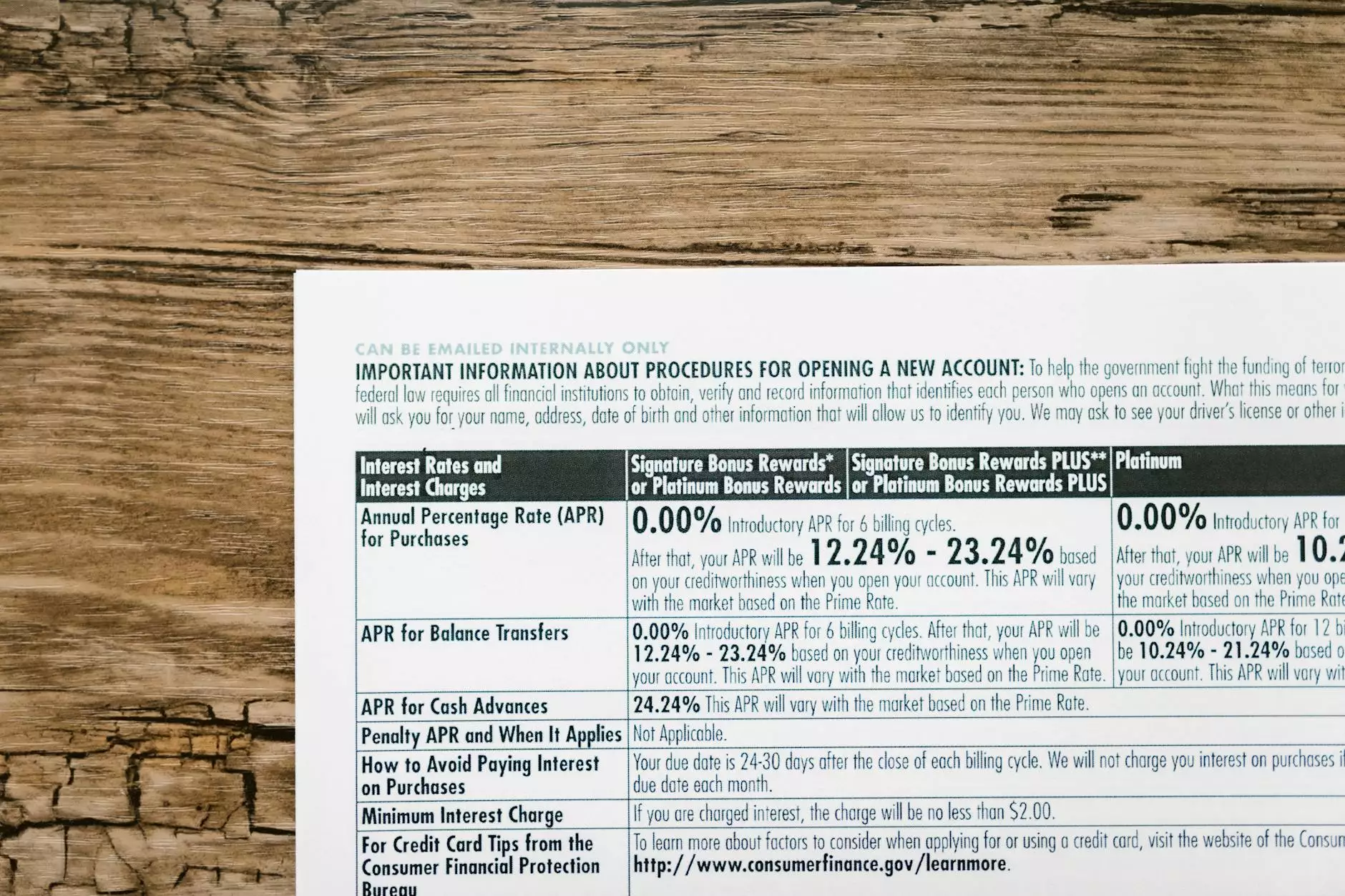

- Easier Loan and Funding Applications: When financial institutions review loan or funding requests, they often require audited or properly maintained financial records. By complying with Section 44AA, you can streamline the loan application process and increase your chances of approval.

How TaxWorry Can Help

At TaxWorry, we understand the complexities of tax laws and the challenges professionals face in maintaining books of accounts while running their businesses. Our team of highly skilled accountants and financial experts will guide you through the intricate process of complying with Section 44AA.

Our comprehensive financial services include:

- Tax planning and optimization strategies

- Bookkeeping, account management, and financial statement preparation

- Assistance with maintaining records and supporting documentation

- Timely submission and compliance with income tax regulations

- Expert advice on tax-saving opportunities

With TaxWorry by your side, you can focus on your core business activities while having peace of mind knowing that your financial matters are in the hands of experienced professionals.

Conclusion

Section 44AA of the Income Tax Act plays a crucial role in ensuring professionals maintain accurate books of accounts, comply with income tax regulations, and maximize tax benefits. By availing the expert financial services, accountants, and tax services of TaxWorry, you can embark on a journey towards optimized tax liabilities, enhanced financial transparency, and smoother business operations.

Don't let the complexities of tax laws hold you back. Contact TaxWorry today to reap the countless benefits that come with professional financial guidance and compliance with Section 44AA!