Section 44AA: A Comprehensive Guide to Tax Compliance for Businesses

Introduction

Welcome to taxworry.com, your go-to resource for Financial Services, Accountants, and Tax Services. In this comprehensive guide, we will delve into Section 44AA, a crucial provision for tax compliance that every business owner needs to understand.

Understanding Section 44AA

Section 44AA of the Income Tax Act pertains to the maintenance of accounts by individuals and businesses. It lays down the guidelines for bookkeeping, requiring certain categories of taxpayers to maintain proper books and records for accurate financial reporting. Compliance with Section 44AA is crucial to ensure transparency in financial dealings and avoid legal consequences.

Who does Section 44AA apply to?

Section 44AA applies to:

- Persons engaged in a profession (such as doctors, lawyers, architects)

- Persons engaged in business (such as traders, manufacturers, retailers)

- Individuals and Hindu Undivided Families (HUFs) who fall under the specified income thresholds

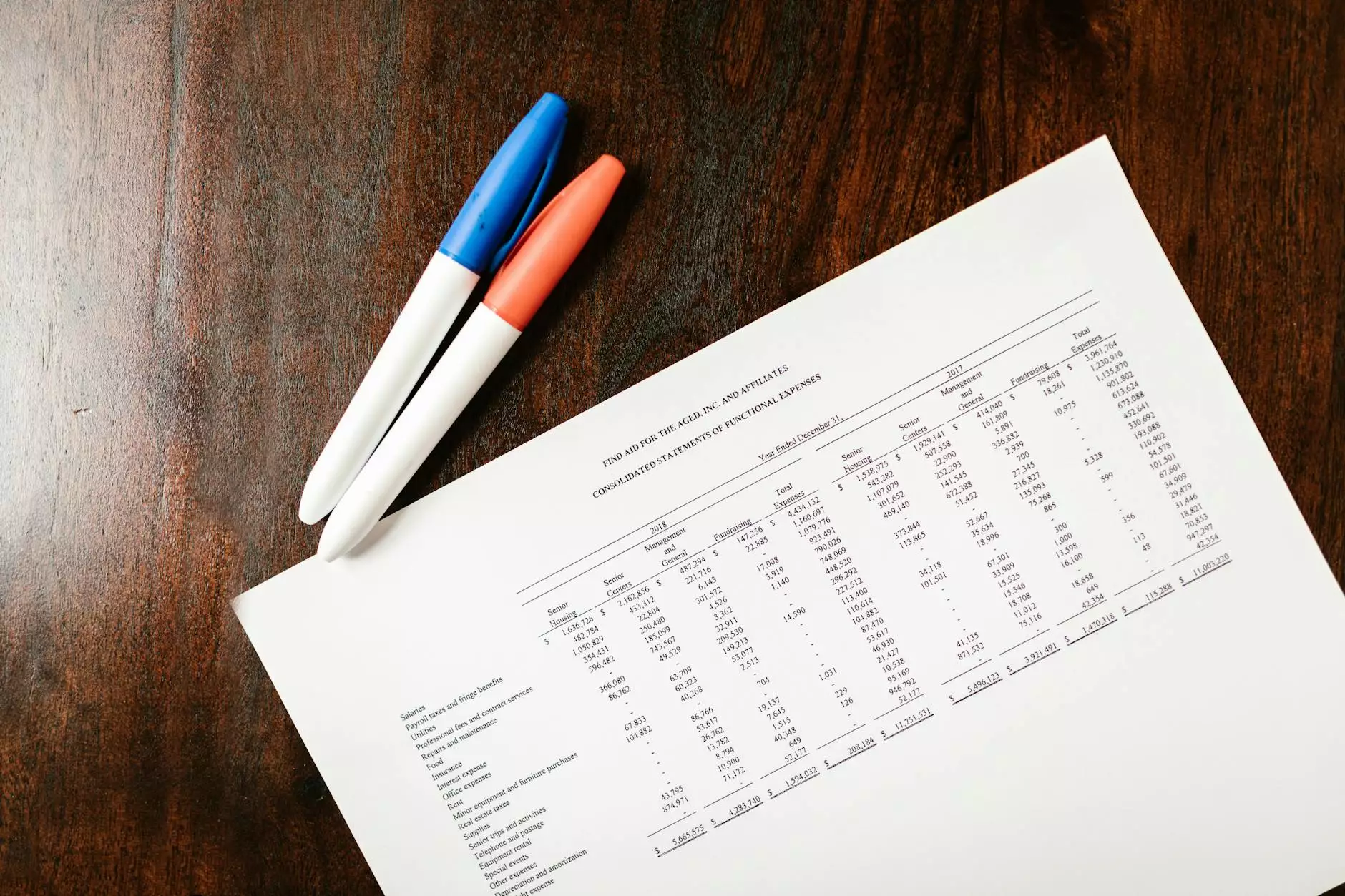

Maintenance and preservation of books of accounts

Businesses and professions covered under Section 44AA are required to maintain proper books of accounts to ensure accurate financial reporting. These accounts should be preserved for a specified duration as per the provisions of the Income Tax Act. While the Act does not specify the format or type of accounts to be maintained, it is prudent to follow generally accepted accounting principles and norms.

Benefits of compliance

Compliance with Section 44AA offers several benefits:

- Helps in accurate tax computation and filing

- Facilitates effective financial management and decision-making

- Ensures transparency and accountability in business transactions

- Minimizes the risk of penalties or legal issues

How to ensure compliance?

To ensure compliance with Section 44AA, businesses and professionals can follow these steps:

1. Maintain proper books of accounts

Adopt a systematic approach to maintain your books of accounts. This includes recording all financial transactions, maintaining ledgers, preparing balance sheets, profit and loss statements, and other relevant documents. The level of detail required may vary based on the nature and scale of your business or profession.

2. Seek professional assistance

Engaging the services of a qualified accountant or tax professional can greatly assist in meeting the requirements of Section 44AA. They possess the necessary expertise to ensure accurate bookkeeping, tax compliance, and assist with financial planning.

3. Periodic review and reconciliation

Regularly review and reconcile your accounts to identify any discrepancies or errors. This will help maintain accurate and up-to-date financial records, making it easier to comply with tax regulations.

4. Preserve relevant documents

Preserve all relevant documents, such as invoices, bills, receipts, and bank statements, as per the prescribed duration. This will ensure readiness for tax audits and inquiries, if any, and strengthen your financial credibility.

5. Stay updated with tax regulations

Keep abreast of any amendments or changes to tax laws and regulations. This will help you adapt your bookkeeping practices accordingly and ensure ongoing compliance with Section 44AA.

Conclusion

Understanding and complying with Section 44AA is vital for businesses and professionals to navigate the complexities of tax compliance. By maintaining proper books of accounts and seeking professional assistance when required, you can ensure accurate financial reporting, minimize risks, and benefit from a transparent and well-managed financial framework for your business.

For expert advice and comprehensive tax and accounting services, trust taxworry.com - your partner in Financial Services, Accountants, and Tax Services. Contact us today to experience excellence in tax compliance.